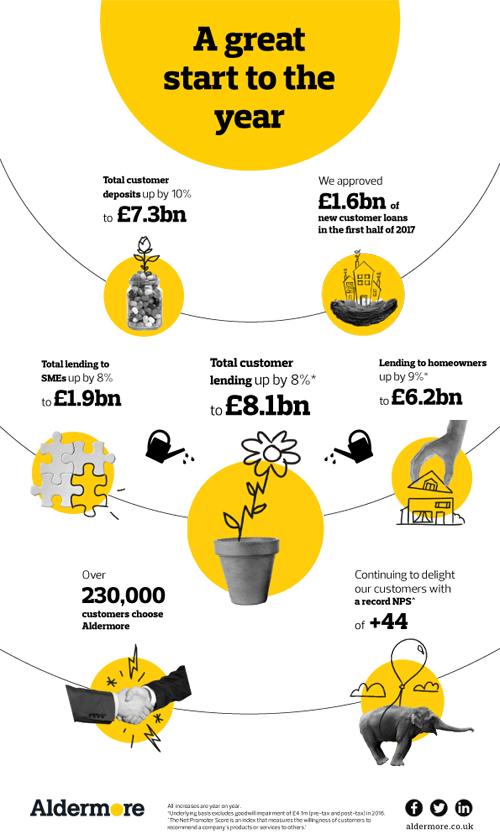

Pre-tax profits at Aldermore Bank leapt 32% in the first half of the year, the business has announced.

The bank saw profits rise nearly £20 million to £78 million for the year to the end of June compared to the same period in 2016.

Its operating income rose 17% year-on-year to £150m, while loan originations were up 10% to £1.6 billion. Business finance loans increased 8% year-on-year to reach £8.1bn.

Phillip Monks OBE, CEO of Aldermore, said: “We have made excellent progress during the first half of 2017, building on our track record of delivery in loan growth, deposit growth and profitability, leaving us well positioned entering the second half with a strengthened capital position and a strong pipeline of new lending.

“We have continued to adopt a balanced approach to growth through strong organic origination and a consistent, robust approach to risk management.”

Monks added that Aldermore Bank remained focused on helping SMEs access working capital and investment funding.

He said the agreed investment in AFS, one of the UK’s largest asset and commercial finance introducers, highlighted Aldermore’s continued commitment to the market.

In June, Aldermore announced the acquisition of a 48% minority equity stake in AFS.

Monks added: “We are delighted with the performance and strategic progress made so far in 2017. Whilst we remain vigilant to the risks posed by the economic uncertainty facing the UK, continued earnings and balance sheet momentum provide us with greater resilience and position us well to capitalise on further strategic opportunities.”