Lower jet fuel prices may allow the current generation of narrow-body aircraft, such as the A320ceo and the B737NG, to remain economically competitive with next-generation aircraft, such as the A320neo and the 737 MAX.

Fitch explained: “If the current models maintain higher values they would provide securitizations with higher-than-expected cash flow. Low fuel costs may also support airline profitability, lowering potential default risks in the near term.

“If the operating cost differential between current- and next-generation technology decreases, demand for the B737NG and A320ceo families could prove more resilient than forecasted and cash flow/securitizations would be positive.”

Next-generation narrow-body aircraft are expected to enjoy operating advantages over their existing counterparts, due to lower maintenance, lower emissions and customer preference.

“However, the main benefit of these models is their lower fuel consumption, which is key to airlines whose largest operating expense is fuel. The new models are expected to deliver 13%-15% incremental fuel-burn savings over their predecessors.

“As a result of this improved efficiency, it has been said that Boeing and Airbus have attempted to capture a portion of the lifetime savings benefit in the prices for the new equipment. If that benefit erodes as a result of lower fuel prices, the economics of in-place technology with lower price points begin to improve.”

Fitch forecasts that while valuations and demand for older aircraft may benefit, new aircraft will still be needed to meet continued traffic growth. It does not expect the performance of next-generation aircraft to suffer.

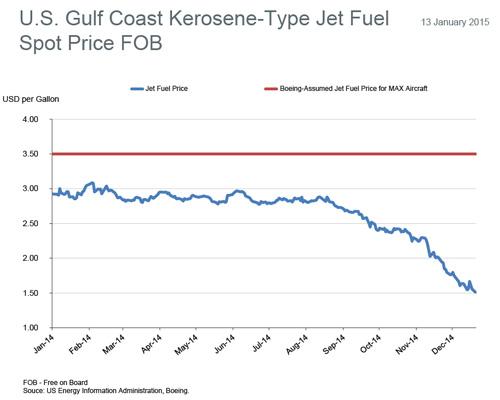

According to the International Air Transport Association, as of Jan 2, 2015 the average price for jet fuel was $1.71 per gallon, 18.1% lower than the prior month and down 43.2%, year over year.

A sustained drop in the long term could potentially have an impact in the estimated operating cost reduction of the A320neo and B737 MAX. The current jet fuel price is 51.1% lower than Boeing has assumed in calculating the estimated $112 million in cost savings for a fleet of 100 B737 MAX 8s.