The first quarter of 2016 saw the global markets buffeted by major headwinds such as the continuing slowdown of China’s economy and collapsing oil prices. Surplus production, falling commodities prices and weak demand contributed to fears of renewed recession and confusion regarding future monetary policy.

European markets have of course been affected, although manufacturers and private consumers are benefiting from reduced energy costs and low interest rates. And despite the main driver for growth being debt-fuelled household consumption, Europe’s economies are proving resilient and are gradually strengthening.

It’s a slow process. The European Commission’s Winter 2016 Economic Forecast predicts GDP growth in the EU of 1.9% in 2016 and 2.0% in 2017, with inflation rising from 0.5% in 2016 to 1.6% in 2017, and unemployment gradually edging down. It is generally assumed that oil prices will rebound, although the effect of low prices will persist in the near term.

The economies of the Nordic and Baltic countries face varying challenges, but on the whole the projections are positive.

Nordic strengths and weaknesses

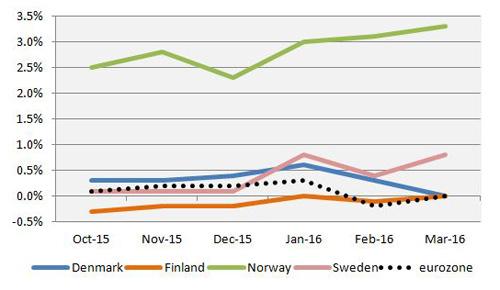

Among the Nordic countries, Sweden’s economic performance continues to be well ahead of its neighbours. Norway has survived the pressure of low oil prices thanks mainly to a weak currency. Denmark’s economic growth remains modest, driven by household consumption which has been helped by a strengthening labour market.

In Finland the rate of GDP growth has at least risen into positive territory, but the economy is still hampered by stagnation and issues of lack of competitiveness and public debt reduction need to be addressed. However, on the bright side, the most recent Global Competitive Index published by the World Economic Forum ranks Finland second globally for innovation – a positive sign for start-ups and new technology.

Nordic countries – real GDP growth

Source: Nordea Markets, February 2016

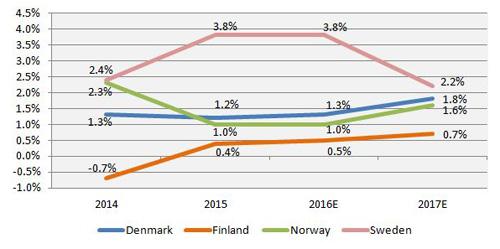

Long-term inflation targets are mostly aimed at close to 2%, which is the European Central Bank mandate for the eurozone. Finland is the only Nordic country in the eurozone and it has spent the last six months mainly in deflationary territory, which the broader monetary union slipped into in February before hauling back to a zero rate. With Denmark also falling to zero inflation, 2% seems a distant prospect. However, projections are for a gradual rise. In Sweden, the trend is definitely upward and projected to continue to rise towards 1.5%.

Norway is the obvious outlier, with inflation of above 2% and currently rising even though the central bank has reduced the base rate, which in keeping the currency weak has raised import prices and therefore reduced consumption.

The Norwegian base rate is now at 0.5%, but this compares with 0% in the eurozone, 0.05% in Denmark, and an unprecedented -0.5% in Sweden.

Inflation rates – Nordic countries vs eurozone

Source: Central Banks, Eurostat

Constraints on the Baltic States

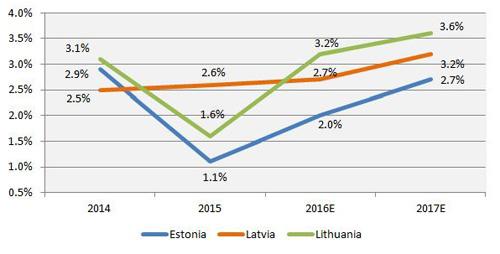

GDP growth in the Baltic States suffered a setback in 2015, primarily due to the decline in the Russian economy and exacerbated by the ongoing sanctions war between the EU and Russia. While the downturn in the Russian economy continues, the Baltic economies will be adversely affected. However, the Markets Division of Nordea Bank states in the February 2016 Economic Outlook that a return to growth is expected in Russia “later in the year”, although it adds that “ongoing volatility in the commodities market makes the timing of a turnaround uncertain.”

All three Baltic States’ exports have been seriously muted by the situation in Russia, with household consumption the main driver of growth.

Baltic States – real GDP growth

Source: Nordea Markets, February 2016

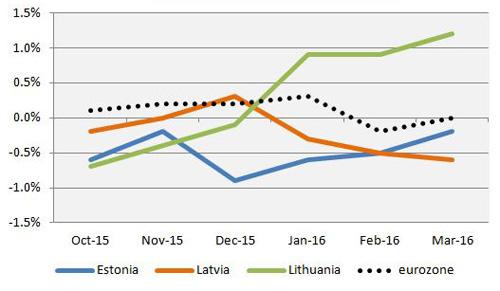

Compared with the Nordic countries, inflation rates in the Baltics are mostly unimpressive, with only Lithuania pulling away from deflation – although this has been fuelled by record investment in real estate.

However, according to Nordea Markets, at least in Estonia the economic fundamentals remain solid.

Inflation rates – Baltic States countries vs eurozone

Source: Central Banks, Eurostat