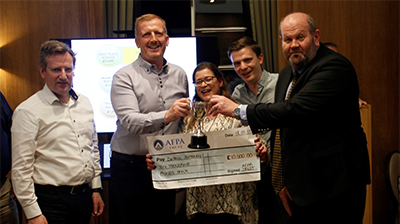

At the UK Finance & Leasing Association dinner on 24 February guest speaker Robert Peston, BBC News economic editor said: “I feel passionately that you lot are the good guys, and what you do is absolutely vital for our economy.”

It was a brave statement given the diversity of his audience but certainly one that properly reflects the role of the leasing industry.

How things have changed from less than 10 years ago when every year at Budget time, and often in-between too, the Chancellor would announce changes to legislation to close down what were described as leasing tax avoidance schemes.

In reality these had little to do with genuine leasing. They were often schemes designed to exploit weaknesses in the leasing tax rules, making arrangements look like leasing when actually they weren’t. They harmed the reputation of our industry and made it more difficult for leasing companies to finance real business investment. The scale of some of the leasing schemes and the potential threat to the Exchequer was, I was reliably informed, quite staggering.

The problem has not completely gone away. Last week HM Revenue & Customs issued new rules preventing firms from claiming capital allowances on items of plant and machinery they have acquired if they haven’t paid an open market price for them.

HMRC said this was in response to proposed sale and leaseback arrangements that could have created substantial capital allowances on assets that had previously entitled their owners to no allowances.

The effectiveness of this government’s new anti-avoidance measures, together with recent damaging reports into the tax avoidance activities of large audit firms, mean that steps like the one last week are fortunately now few and far between.

With tax avoidance fast becoming an election issue, the Liberal Democrats are proposing making failure to prevent tax evasion a criminal offence, targeting accountants, lawyers and bankers. That seems a particularly impractical policy. However it’s still lucky that those involved in the real leasing industry - lessors and advisers alike - are now firmly recognised as the ‘good guys’.

Julian Rose is the founder of Asset Finance Policy Ltd, previously he was Head of Asset Finance at the UK Finance & Leasing Association. www.assetfinancepolicy.co.uk