The European leasing market in 2014 is in new production terms around €276 billion. Vehicles & equipment account for approx. 95% with real estate leasing comprising the balance of 5%.

In 2014, leasing enjoyed a 24% penetration of all business equipment investment across Europe.

When we look at new business production – bank-owned institutions dominate the picture with €223 billion or around 81% of total new business production. Captive finance companies account for €44 billion or 16% of new business production and the balance of the market of 3% is taken up by independents.

What is clear is that whichever perspective one adopts bank owned leasing businesses dominate the picture.

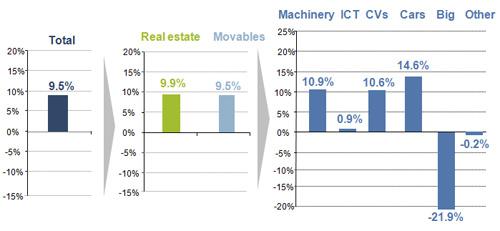

New lease volumes per asset type

This chart provides an overview of the new business production by asset type financed. As you can see the market overall has grown by 9.5%. This overall % growth rates breaks down into real estate growth of c. 10% and 9.5% in respect of movables in the form of vehicles & plant & equipment.

On the right hand side of the slide you can see the underlying asset type progression. The term “Big” in the context of this presentation refers to deals where the ticket size is in excess of €25 million.

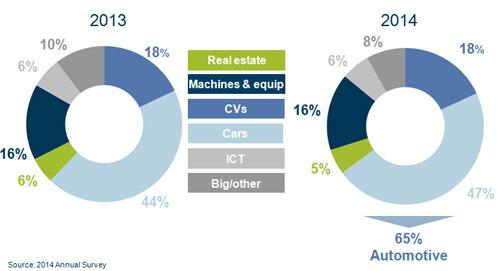

Leased assets share of total NBV per asset category

As you can see, vehicle financing comprises c 65% of total new business production. Vehicles will generally always form a strong core of the assets to be financed but I was personally surprised that with all the motor financing initiatives in 2014 the share that vehicles took of the total market was not actually larger. If one looks back over historic time series data we would appear to be in new territory as vehicle financing has previously been on average c. 55% of total new business production.

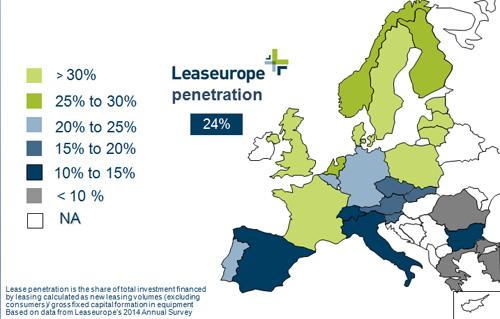

Share of equipment investment financed by leasing

This chart relates to the penetration rate of leasing in relation to total investment. I said earlier that leasing accounts for c. 24% market share of total European investment. You are looking here at a heat map in respect of penetration rates by jurisdiction.

Noting the dominance of the bank owned businesses I am struck by two things – why is it that the share of the total market taken by bank owned institutions as well as the total quantum of lending undertaken by way of leasing is not larger than it is?

I ask this because given the relative risk weights between most other forms of bank provided debt and lease finance, as we continue to emerge from the global liquidity crisis, I would have expected the drive for capital efficiency to have shown a greater overall “substitution” effect to already have taken place within bank owned institutions.

My comment is predicated upon the key findings within the Leaseurope research that leasing is within authorised institutions without question relatively more capital efficient than most other forms of bank debt.

Leasing as an investment vehicle

Although important, a substitution effect for capital efficiency purposes is one thing that is likely to drive future growth. However, it is supply side only driven effect. What of the demand side of the equation? Is leasing attractive as an investment vehicle? How successful has the leasing industry actually been in getting this message out there to all stakeholders?Economic logic would suggest that a substitution effect between bank debt and asset based lending should occur. Looking at the data, it does not appear to have happened to any great degree at present. Should I conclude from that that my peer group – the business leaders of bank owned leasing businesses – have been to date unsuccessful in terms of winning over their shareholders?

As far as external stakeholders are concerned, it appears that the industry has been a bit like the curate’s egg – good in parts. If one was writing a school report for the industry perhaps the expression – “Could do better” would apply.

Leaseurope has just completed a new research project conducted in conjunction with Oxford Economics. The research looked into the Importance of Leasing amongst European SME’s where an SME is determined by the number of employees being in overall terms less than 250.

SME’s have long been held and proven in many cases to be the engine of economic growth. The key finding from the latest Leaseurope research is that an increase in the usage of could create an important boost in European GDP growth of between 0.3% to 0.7%.

Quantum of lending

From a leasing industry perspective the “holy grail” would be not only to secure an increase in the overall penetration of leasing, but also to increase the overall quantum of lending undertaken by way of leasing.

I want to make clear here that the envisaged range of growth in GDP is not down to fiscal advantages. I do not discount the possibility of any fiscal boost but the research indicates that any fiscal advantage available would be incremental to the mix.

At the risk of being controversial, the challenge of the industry as a whole – whether it be a trade association level or at individual lessor level – is to ensure that we position the product of leasing in our marketing activities as economy and investment friendly.

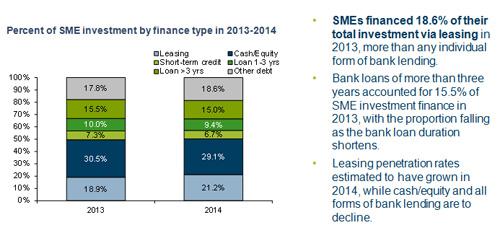

Leasing is the most important external finance contributor to SME investment spending

One can see from this chart that leasing already accounts for over 18% of total SME investment. Bank loans account for approx. 15%. The Leaseurope research indicates that leasing as a form of investment is forecast to grow in usage terms.

Whether it is possible to position leasing in an industry as dominated as the leasing industry appears to be by bank owned businesses is an integral part of that challenge. It is however the role of senior management within bank owned leasing businesses to get the capital efficiency message across to their internal stakeholders and to have them allocate capital accordingly.

Reciprocal gain

Why should banks do this? Well we know from the research that bank provided non lease debt accounts for c. 15% of total SME investment. Having a sizeable substitution effect applied to this would be a start and would help drive leasing forward on the demand side with the reciprocal gain of better balance sheet efficiency as a spin off side benefit.

It would be remiss when considering the relative economic attractiveness of leasing to just consider external factors. Via Leaseurope and the annual surveys we gain good insight into the relative performance of leasing businesses (and therefore into the relative attractiveness of leasing).

In summary therefore we appear to have a market where the top 10 players (measured in terms of new production) account for c. 60% of the total market. The top 20 lessors account for c. 80% of the industry. Faced with this degree of market concentration, is the European leasing industry difficult to enter?

Again, at the risk of being somewhat controversial, it should be. In reality, it is not. Why should this be important to us?

There is a tsunami of liquidity looking for yield. If yield or return can be secured and credit losses mitigated at the same time by way of underlying asset ownership, then do not be surprised to see capacity being attracted into the leasing industry. New capacity in any shape or form is likely to come with a corresponding downward impact on margins.

We are already beginning to see new insurgents enter. In the UK we have a number of new players that have entered or are in the process of entering the market – Cabot Square, Star Capital & Highbridge Securities to mention a few.

In considering & developing some likely future scenarios, I believe that the European leasing industry is at a cross roads. It is clearly the case that private equity players see potential value in entering this industry. The paradox is that at the same time, some of the bank owned in situ players have, for a variety of reasons, come to regard leasing as a non - core activity.

There are those who have exited and those that are looking to exit or run down their leasing activities. Therefore one possible scenario is that we will see some subtle and potentially not so subtle changes in the make-up of the industry. An element of this will be a number of new entrants who are likely to look to compete both within and across jurisdictions as they seek to build scale.

George Ashworth has been involved in the leasing & asset financing industry for over 35 years. He is a serving board member of the Leaseurope Federation and the Managing Director of ABN AMRO Lease NV (UK Branch).