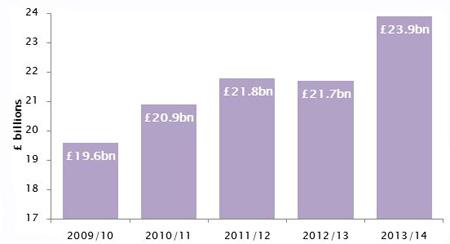

The amount borrowed by businesses through leasing to fund business investment has reached a five-year high, jumping 10% in the last year alone, as more businesses embrace asset finance as an alternative to traditional loans.

LDF, one of the UK’s leading commercial finance groups, confirmed that the amount borrowed by businesses through asset finance has risen 10% to £23.9 billion in 2013/14, up from £21.7 billion in 2012/13*.

Asset finance has grown in popularity since the recession as many businesses have found it difficult to secure the traditional lending that was their mainstay prior to the credit crunch.

Leasing hits five-year high as businesses return to investment in growth

*Year end July 31 2014

Source: Finance and Leasing Association

Many SMEs use asset finance to fund purchases such as updating their IT systems, office refits and other assets such as commercial vehicles, which may have fallen to the bottom of their priority list during the credit crunch.

As the UK economy improves, SME’s are seeing order book growth, and are looking to catch up on several years of delayed investment. While many other forms of lending remain relatively constrained, the availability of asset finance makes it hugely attractive in comparison.

As a result LDF, like many other UK lenders, is currently experiencing significantly increased levels of demand from businesses.

LDF’s experience mirrors the upturn in both UK business and consumer confidence in the last 12 months.

However, this upturn in new business growth beggars the question whether asset lenders and lessors are reviewing their technology systems in the race to compete for the business. Alongside the expansion in new business, therefore, comes the vexed question whether or not to invest in new systems – and maximise the return from the new business boom.

Typically, however, new software implementations have long delivery timescales and are subject to operational risk.

AutoRek, a leading provider of automated reconciliation software, financial reporting and regulatory reporting products is able to provide a cost effective, efficient, low-risk method of automating the financial controls that manage the growth of a lending business.

In a new White Paper Transforming Financial and Operational Control in the Asset Finance Industry, AutoRek explains how to maintain an efficient and cost-effective controls environment during a business up-turn.

The White Paper stresses: “All lenders need an efficient and cost-effective controls environment. AutoRek can provide that integrated view and financial management that should be crucially at the heart of all finance companies.”

It adds: “The core of the business case for investment is a typical year-one payback by delivering a 50% - 75% reduction in processing and reconciliation resources. Other benefits include a clearly demonstrable improvement in downstream processes and auditability, and a capacity to absorb greater volumes of work with a much flatter cost curve.”

To download a copy of Transforming Financial and Operational Control in the Asset Finance Industry click here