Auto finance will be vital to driving future profit growth at Opel/Vauxhall as new owner PSA Group launches a Europe-wide review of the dealer network.

Current dealer contracts will be terminated at the end of this month, affecting the entire 1,600-dealer network, including 400 in Germany and more than 320 in the UK,

This will start a two-year notice period during which new contracts will be agreed, most likely with a smaller number of dealers.

Dealers throughout Europe have been contacted about the changes and briefings are ongoing, including a major UK dealer conference taking place on May 1.

The review is part of the PACE! plan revealed last year by PSA Group after it acquired Opel/Vauxhall, with a plan to make the business profitable by 2020.

The shift includes offering a wide range of electrified options by 2024 and fostering growth of the Opel/Vauxhall LCV business.

PSA Group said when it launched PACE! that the plan included changing dealer agreements, a process that has also been carried out by other major manufacturers as part of network reviews.

New contracts will be offered by 2020 that focus more on profitability and rewarding dealer performance in areas such as customer service and loyalty, to encourage customers to return to dealers for their next car.

As part of the change, all dealers will be allowed to sell commercial vehicles, which is seen as a key area for growth.

Vehicle architecture will also change. From 2024 onwards, all Opel/Vauxhall passenger car models will be based on joint PSA Group architectures.

Despite the changes, the role of auto finance will remain at the core of dealership operations and while PSA Group is reviewing the network, Opel Vauxhall Finance (OVF) is actively expanding throughout Europe.

Earlier this year, OVF, which trades under brands including Opel Bank, Opel Financial Services and Vauxhall Finance, launched its strategic plan for growth following its acquisition by BNP Paribas and PSA Group.

Under the plan, the captive finance organisation aims to finance every third Opel vehicle by 2020, a 50% increase compared to 2017,

Alexandre Sorel, CEO of Opel Vauxhall Finance, said: “Our plan provides a clear roadmap to increase efficiency and to contribute to Opel/Vauxhall performance across all channels.

“Our agile and ambitious team is fully committed to meeting the mobility needs of its customers across Europe, while sustaining and developing the Opel and Vauxhall brands through competitive automotive finance solutions.”

To encourage growth in commercial vehicle business, OVF will offer full-service leasing for fleet customers in Germany in 2018 through Opel Bank.

Other markets, including Austria, France Italy and the UK, will also benefit from new B2B finance initiatives.

Mobility packages that combine leasing, insurance and service products are additional strategic growth elements for OVF.

While these product bundles are already available in some countries, the objective is to launch them in all OVF markets, boosting Opel and Vauxhall sales through joint marketing campaigns.

As well as broadening the product portfolio in existing markets, OVF also plans to enter new markets.

Its most recent launch was in Spain, one of fastest growing automotive markets in Europe with more than 1.2 million new car registrations in 2017, a year-on-year rise of 7.7%.

Opel is the fifth largest manufacturer in the country by sales, with 6.59% market share and 94,609 vehicles registered in 2017.

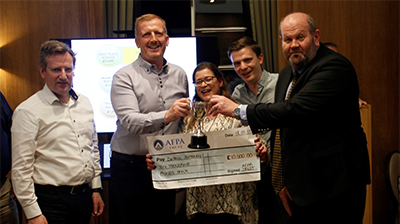

OVF launched in Spain at the start of April, supported by Banque PSA Finance and BNP Paribas Personal Finance.

Sorel said: “Entering the Spanish market is an important milestone for us. As Opel´s captive finance organisation we can substantially support Opel´s growth plans in the country.”

Pascal Brasseur, deputy CEO of Opel Vauxhall Finance, added: “Attractive finance solutions are an important strategic element to sustain and develop the Opel brand in Spain, and we are fully committed to meeting the mobility needs of our Spanish customers.”

Trading as Opel Financial Services, it will offer its classic finance products as well as credit insurance, total loss solutions, and maintenance, guarantee programmes and new services, such as FlexiOpel Plan, a balloon product.

In the long-term, OVF plans to expand its geographical footprint to 90% of Opel/Vauxhall’s European markets. In 2017, OVF represented around €9.4 billion in total financing across 11 countries.