UK new and used car finance applications processed by Experian rose to 597,000 from 1 July to 24 August, compared with 481,000 in the same period during 2019, signalling a 24% increase.

As the widely forecasted pent-up demand for vehicles began to flood the market in the traditionally quieter summer months, sales rose in July for the first time this year, although total sales since January are still far below 2019 levels.

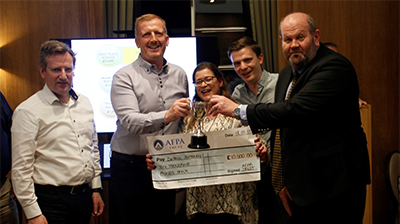

Gerardo Montoya (pictured), head of automotive at Experian, explained: “Our figures show car finance applications have picked up markedly since customers returned to forecourts in June. Demand has come from people whose income has not been affected by the pandemic and have money in their pockets, as well as those who are uncomfortable using public transport.”

According to Experian, personal contract purchase (PCP) deals have seen a surge in popularity in the UK, with four out of five private buyers opting to use the agreement. As a potential explanation for this, Experian suggested that many car owners who were due to renew or change their PCP contracts during March, April or May were offered extensions, delaying their purchases of new cars into the summer and offering a boost to showrooms struggling to attract buyers.

Furthermore, Experian’s figures for the UK show that at the time showrooms reopened in June, there had been 390,000 fewer applications for car finance in 2020 compared to the year before. However, the pent-up demand has seen the deficit cut down to 234,000 fewer applications.

Experian checks on PCP and hire purchase (HP) agreements across new and used vehicles plummeted 82% in April and 57% in May, marking a gloomy start to the lockdown. However, pent-up demand led to a 28.5% rise in applications in July, and an 18.6% increase between 1-24 August.

Activity on Experian’s Marketplace, where people can compare car finance deals and check their likelihood of being accepted, shows that searches have increased by 291% since the lockdown began, suggesting many people are looking for ways to finance a car purchase in the coming weeks.

Experian data on car finance applications (PCP & HP) in 2019 and 2020

| Month | 2019 applications | 2020 applications | YoY change |

|---|---|---|---|

| January | 232,362 | 244,982 | 5.3% |

| February | 285,202 | 306,916 | 8.0% |

| March | 323,585 | 261,890 | -18.4% |

| April | 250,548 | 44,248 | -82.1% |

| May | 267,187 | 44,248 | -57.4% |

| June | 267,343 | 303,593 | 13.4% |

| July | 270,012 | 347,063 | 27.7% |

| August - 24th | 211,137 | 250,309 | 18.6% |

September revival

A combination of strong car finance application figures and a surge in searches for deals online has given motor traders a boost as the new ‘70’ registration plate launches. The arrival of the new plate makes September a critical month for motor traders who need to make up for lost time during lockdown.

Montoya added: “September’s plate change offers a chance for motor traders to recover more of the sales they missed out on during lockdown. There’s been a surge in people searching for car finance on price comparison websites which suggests forecourts could be busy. Motor traders will rely on data to understand people’s financial situations and how they may have been affected by coronavirus, so the finance deals they offer are affordable for the long term.”

The automotive industry as a whole, is hoping for a strong September to dampen the negative effects of the year so far, but a true picture of consumer confidence and the overall economy is not anticipated until the furlough scheme ends in October.