‘A welcome aid to struggling businesses but we need more’, seems to be the message to government from the asset and auto finance market following the Chancellor’s announcement of the Winter Economic Plan.

Taking mainstage in the plan is an extension to government support measures including CBILS and BBLS for struggling businesses, including further VAT cuts for the hospitality and retail sectors.

Furthermore, a new wage subsidy facility is set to replace the existing furlough scheme which ends in October and has so far cost £39 billion, according to the Financial Times. As with the furlough scheme, the government will top up the wages of workers who can only work part-time in viable jobs.

Sunak said the scheme would be targeted at the firms which need it the most, with all SMEs eligible. However larger businesses will only be eligible if their turnover has fallen as a direct result of the crisis.

Starting in November, the new wage subsidy scheme will run for a further six months and is forecast to cost around £300 million a month.

Another major point of interest in the new plan was a ‘pay-as-you-grow’ scheme to boost cash flow and reduce the burden of paying back coronavirus loans. The Chancellor recognised the need for businesses to funnel funds to protect jobs rather than repaying loans stating that “loans can now be extended from six to 10 years, nearly halving the average monthly repayment.”

Under this facility, struggling businesses will be able to make interest-only payments while those in “real trouble” will be able to suspend all repayments for six months.

In response to the announcement, the auto and equipment finance industry released a flood of comments on the economic plan, giving a vital insight on how the sectors view the various aspects.

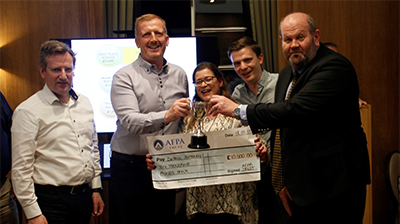

Gerry Keaney (pictured above), chief executive of the British Vehicle Rental and Leasing Association (BVRLA), explained: “Businesses most affected by the pandemic need all the help they can get right now and we welcome the Chancellor’s decision to extend financial support beyond October. Our latest COVID Survey shows that 37% of BVRLA members expect to have employees still on furlough at the end of October, so this additional support will help to stem potential job loss.

"Our industry is resilient and continues to adapt ways of working to protect lives and livelihoods, but cash is king when it comes to survival and this additional support will provide a lifeline for many organisations that are battling to maintain a sustainable business and protect jobs.”

Stephen Haddrill, director general of the FLA, said: “It’s good to see that the Chancellor has accepted our recommendation to extend CBILS, and we look forward to seeing what the successor scheme for 2021 will look like. We have already proposed a revised version of the Enterprise Finance Guarantee Scheme.

“What hasn’t been addressed in today’s announcement, and what continues to be a challenge for our independent lenders, is access to funding that can then be deployed under the guarantee schemes. Our members are ready and willing to support SMEs, but they can’t do that without funds.”

Chirag Shah, chief executive officer of Nucleus Commercial Finance, added: “The announcement of an extension to both the CBILS and BBLS is welcome news for business owners throughout the country, who are looking for access to fast and flexible finance now, more than ever before.

“SMEs are the backbone of our economy, and we hope these measures will provide British businesses with the support they need at this challenging time. But while this announcement provides immediate relief to small businesses, the Chancellor must also deliver long-term plans to ensure they can not only survive the Coronavirus crisis, but thrive for years to come: this is where the alternative finance industry has a vital role to play.”

Mike Cherry, national chairman of the Federation of Small Businesses (FSB), said: “It’s encouraging to see that all small businesses will be able to access the new job support scheme without facing excessive paperwork, with a guarantee of help for the next six months.

“News of the ‘Pay as You Grow’ approach will mean relief for hundreds of thousands of firms, giving them the confidence to invest and hire today rather than tomorrow, providing a crucial option to suspend repayments for six months. We called for an extension to the deadline for emergency finance facilities and that extension has rightly been delivered today. The assurance on credit ratings will be hugely welcomed by many worried small business owners.

“We are concerned that the Chancellor had nothing to say today on support for those who were left out of the first round of support measures, not least the newly self-employed and company directors. Equally, local lockdown grants should now be extended to firms forced to closed that were counting on reopening in the coming weeks but now face the most difficult of winters.”

Josh Levy, chief executive officer of Ultimate Finance, explained: “Whilst the devil will be in the detail and it’s unclear whether this new plan goes far enough in terms of targeted support for the most impacted sectors, it does nonetheless feel like a positive step in smoothing the various cliff-edges for SMEs that were so obviously looming.

“Non-bank lenders have a critical role to play in funding SMEs through this crisis and enabling the return to growth. As a CBILS accredited lender we’re pleased that businesses will have the opportunity to continue accessing funding under these schemes until the end of the year with plans for a replacement scheme in 2021.”

Claire Ralph, policy manager at Business West, added: “The Job Support Scheme, is considerably less generous than its predecessor, given that employers will pay at least 55% of employees’ salaries from 1 November. The Chancellor has opened this up to all sectors, rather than offering the more tailored support for those which have disproportionately affected that many have been calling for.

“Extensions to the Self Employment scheme and the government backed loan schemes are welcome to assist cash flow for struggling businesses, and longer repayment terms for loans and tax deferrals could be critical to prevent insolvencies in those with the fewest reserves to cope over the winter.”