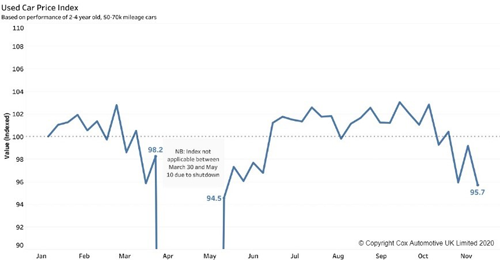

Whilst used vehicle prices and consumer demand has eased during lockdown 2.0, they were already decreasing in October before any announcement of a second wave of national restrictions was made, says Cox Automotive in its mid-month review for November.

Urging the industry to observe the figures in a wider context, Philip Nothard (pictured above), insight and strategy director at Cox Automotive, explained: “With the introduction of a second round of national restrictions at the start of November, many retailers were undoubtedly nervous about how this would impact business for the remainder of the year.

“As it stands, it's unclear whether restrictions will be extended beyond 2 December or not. Regardless, the investment in digital retail being made by automotive retailers, and the experience of the first lockdown in spring, has put businesses in a much better place to weather the storm this time round.”

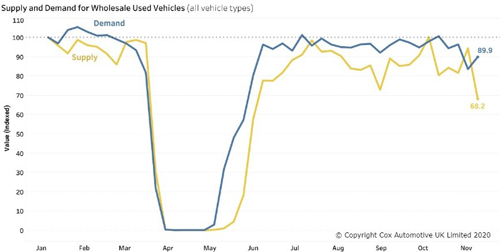

Nothard pointed out that whilst the vehicle supply has once again dipped at the start of November – undoubtedly in part due to the second round of national restrictions – it’s important to remember that a supply dip around this time of year is normal.

He said: “In the wholesale market, vendors typically ease their auction activity ahead of the new year, but the easing has been compounded this year by reduced demand. Vendors are unsurprisingly cautious about entering vehicles into a weak marketplace.”

£22.5 billion loss for new car market

Nothard also stated that the market was in a strong place at the end of the third quarter after a 4.4% year-on-year increase in used car transactions. However, in Cox Automotive’s latest Insight Report, the company predicted that the subsequent easing of supply and demand in the early stages of Q4 meant that the used car sector could be looking at 6.41 million transactions by the end of 2020, down 19.2% on the year before.

The report took a comprehensive look at some of the larger trends influencing the automotive industry. In the report, the company forecast 1.3 million used car transactions in Q4 marking a decline of 25%.

Looking to the new car market, Cox Automotive has revised its projections of 1.66 million new car registrations in 2020 down to 1.57 million. According to the report, this equates to a 32.2% decline on the year before, and a £22.5 billion loss in annual turnover.

Proactive in the face of pandemic

One clear sentiment has arisen across the finance industry as a whole; that in order to endure the numerous challenges that 2020 has posed to automotive manufacturers, retailers, and the wider supply chain, the majority of organisations have had to take an agile approach to business planning.

According to the report, this proactive focus combined with a more digital-friendly approach to business has withstood the unpredictable nature of the market in recent months. Many businesses have benefitted from being able to call on their various scenario preparations to put in place structures and processes from which to rebuild.

Liam Quegan, managing director at Man heim Auction Services and NextGear Capital, explained: "The pandemic has rapidly accelerated the shift towards digital channels that were already taking place. In 2018, we predicted that 80% of wholesale transactions would be digital by 2022. COVID-19 has accelerated that timeline. Since the lockdown, 100% of our transactions have been online. We will see buyers return to physical auctions but not in the volumes experienced prior to March 2020. The blend has now shifted permanently in favour of online buying."