Fitch Ratings believes that lower oil prices, higher expected GDP growth in France and Italy (its main markets) and potential deregulation for the leasing sector will be positive drivers in 2015.

In a new report, Peer Review: Tunisian Leasing Companies, Fitch forecasts that asset quality will remain stable in 2015 given its expectations of a slow economic recovery process in Tunisia.

Tunisie Leasing (TL) and El Wifack Leasing (EWL) are outperforming the leasing sector with lower impaired loan ratios, underlining their prudent credit risk policies.

Residual credit risk compared to equity still represents a major risk, particularly for Attijari Leasing (AL) and Modern Leasing (ML).

Weak funding - tight liquidity

Fitch forecasts that the funding profile is viewed as weak for all leasing companies given their high reliance on wholesale-funding and liquidity shortages in the Tunisian financial market. These companies are significantly exposed to refinancing risk given their reliance on short-term debt and tight liquidity buffers. Undrawn committed bank credit lines are fairly limited relative to annual funding needs for most companies. Therefore, Fitch views access to funding through a bank shareholder as a strong advantage.

The leasing sector, which encompasses nine companies – of which eight are rated by Fitch, remains highly competitive.

Competition is therefore a key driver for Tunisian leasing companies’ strategies, with leaders (such as TL, ATL and AL) accounting for almost half of the total market shares and smaller companies (Best Lease (BL), Arab International Lease (AIL) and ML) fighting to gain additional market shares. Most of the leasing clients are SMEs and professionals, which are the typical targets given the lack of supply from banks. Those clients are also more vulnerable to economic downturns than large corporates.

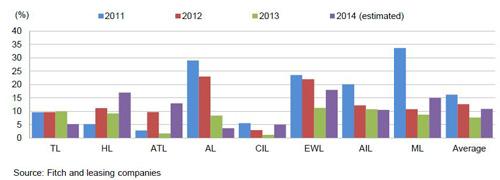

Since 2011, loan growth in the leasing sector has been slowing down. Fitch expects loan growth to accelerate at end-2014 y-o-y and to benefit in 2015 from a more favourable operating environment. However, large discrepancies exist among leasing companies, mostly owing to uneven access to funding and different risk appetites. As such Hannibal Lease (HL) and to a lesser extend EWL, Arab International Lease (AIL) and AL have increased their market shares since the 2011 crisis, despite the fragile operating environment.

On the other end, Compagnie Internationale de Leasing (CIL) and, to a lesser extent Arab Tunisian Lease (ATL), have reduced their new lending and lost some market shares, driven by liquidity constraints or lower risk appetite.

Loan Growth

Asset quality remains a major weakness

With the exception of TL, Tunisian leasing companies’ product diversification is weak (exclusively operating leases, related to vehicles, standard and specific equipment, and, to a lesser extent, real estate) and their leasing services are basic. All of the companies (with the exception of TL) operate exclusively in Tunisia.

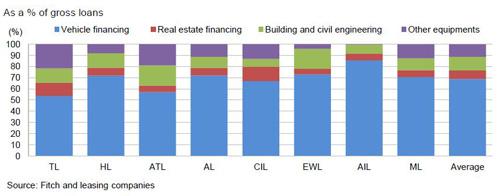

The leasing market remains dominated by small tickets (around TND40,000) and liquid vehicle leases (both light and heavy vehicles). Equipment for building and civil engineering, other specific equipment and real estate financing account for the rest of the financing (see Figure 4).

Leasing by type

Modest underwriting standards and risk management systems

Fitch confirms that leasing in Tunisia is not a complex business; however, risk management policies are basic and poorly automated by international standards.

TL has the most sophisticated systems and tools among peers. Credit risk approaches at both TL and EWL have historically been cautious, reflecting their lower through-the-cycle impaired loan ratios.

AL and ML, whose impaired loan ratios are at the higher end of the range, are lagging behind peers in terms of the sophistication of their IT systems and credit risk monitoring tools.

However, major efforts are under way to upgrade them at AL and, to a lesser extent, at AIL.

AL’s very high impaired loan ratio partly relates to an old stock of impaired exposures, which were originated before 2008, and have been fully reserved but not written off.

The 1H14 surge in CIL’s impaired loans ratio relates to the deterioration of one of its largest clients. Fitch expects this level to decrease to 2013 levels at end-2014 as this exposure was back to performing at year end.

The Tunisian financial services regulator sets relatively loose impairment and provisioning criteria. However, most of the Tunisian leasing companies have individually adopted stricter guidelines, and there are today large discrepancies, mainly related to residual value (RV) calculations. RV risk, early recognition of overdue loans, efficiency of repossession and resale processes, as well as access to second-hand vehicle markets are key measures for gauging the health of leasing companies.

Fitch Ratings Peer Review: Tunisian Leasing Companies can be found at https://www.fitchratings.com/creditdesk/press_releases/detail.cfm?pr_id=979504