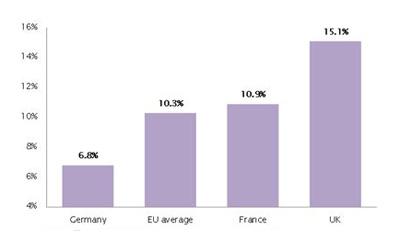

Despite relatively strong growth amongst businesses using asset based finance in France and Germany, both lag behind the UK in both the proportion of the economy supported by asset based finance and absolute terms (UK: 15% and €189.7 billion; France: 11% and €117.7bn; Germany: 7% and €100.5bn).

Around 80% of asset based finance is invoice finance, in which businesses secure funding against their unpaid invoices, while the other 20% represents the fast-growing area of asset based lending, in which businesses can raise funding secured against a range of other assets they own, including inventory, property and machinery.

Aside from the UK, the top three European countries in terms of proportion of the economy supported by asset based finance are:

• Belgium – 14.5% of economy (€29.3bn);

• Republic of Ireland – 13% of economy (€12.7bn); and

• Portugal – 12% of economy (€10.4bn).

UK financial services firms have long been real innovators in developing invoice finance products, and businesses in the UK have traditionally been keen to access this funding. Now the rest of Europe is also following suit.

Invoice finance has played a pivotal role in keeping funding flowing to SMEs as more businesses look to complement or replace traditional bank lending with asset based finance.

Given how important European Union markets are to UK businesses, perhaps what is most encouraging is that more businesses across Europe are realising the value of asset based finance – it’s up 5% overall - and it has cemented its position as a key alternative source of funding for businesses of all sizes.

According to statistics from the ABFA, Q3 2015 saw the use of asset based finance in the UK and Ireland hit a record high, with businesses securing £20 billion through asset based finance for the first time ever, up 4% from £19.3 billion in the previous year.

UK leads Europe in use of asset based finance – UK businesses representing 15.1% of economy supported by asset based finance

*Data from EU Federation Factoring & Commercial Finance statistics for the year to 30th June 2015. ** Total company turnover.

Jeff Longhurst is chief executive of the Asset Based Finance Association (ABFA), the body representing the invoice finance and asset based lending industry in the UK and the Republic of Ireland.