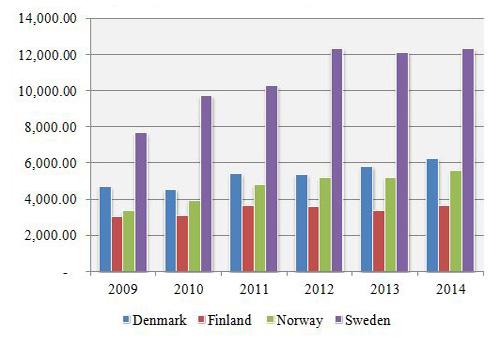

In the Nordic countries, new business volume (NBV) for leasing and long-term rental in the five years following the onset of the financial crisis has not been immune to the continuing economic headwinds, be they global or European. And while the Nordic markets have all grown over this period, nowhere has year-on-year growth been consistent.

Nordic countries, leasing new business volume (€ million)

Source: Leaseurope

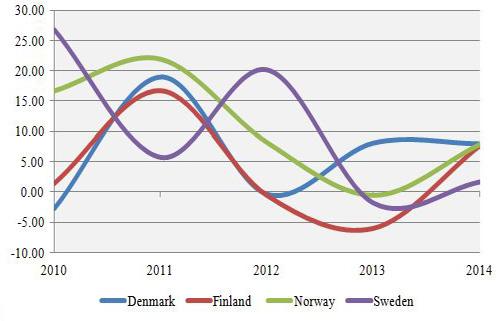

This had particularly been the case in Finland, the only adopter of the euro amongst these countries, and also the most likely to be influenced by the Russian economy and the effects of sanctions. However, in 2014 Finland returned to growth with a near 8% increase in NBV over the previous year, matching performance by Denmark and Norway and outperforming the largest market, Sweden.

As the following chart shows, all four Nordic leasing markets have experienced ups and downs over the last five years.

Nordic countries, new business volume change over previous year (%)

Source: Asset Finance International, Leaseurope

The longer-term trend over the 2009−14 period is shown in the combined annual growth rate (CAGR). Compared to the CAGR for 2009−13, these five-year figures are in fact rising for Denmark and Finland, but have decreased for Norway and Sweden – although growth rates for those markets remain around the double-digit mark.

Nordic leasing markets combined annual growth rate, 2009−2014:

- Denmark: +6.08%

- Finland: +3.59%

- Norway: +10.58%

- Sweden: +9.97%

It should be noted that the national associations in Finland and Sweden are estimated to represent around 80% of their respective leasing markets, as compared with 90% for the equivalent bodies in Denmark and Norway, so total business volumes can be expected to be proportionately somewhat larger in the former markets – although growth rates and trends should be assumed to be unchanged.

It is difficult to forecast growth rates for 2015, as global markets have been hit by the slowdown in China and uncertainty in the eurozone continues. Figures are available for the first half of the year for Denmark, with NBV increasing by 8.7% overall compared to the same period the year before, but there is great volatility within this as quarter-on-quarter growth rates veered from a massive +23.7% in Q1 to -1.80% in Q2.

Meanwhile in Finland, according to the Federation of Finnish Financial Services, equipment leasing new business decreased by an alarming 26% in Q1 2015 compared to Q1 2014, whereas car leasing was static and hire purchase and investment financing both grew, by 10% and 3% respectively.

In Norway, 2015 began poorly with NBV declining by 4.4% compared with Q1 2014 and the slide has continued, although the rate of decline has eased. The most likely contributor to falling NBV is the drop in oil prices that has affected the whole economy, and is likely to make 2015 a disappointing year overall.

Commenting on recent leasing market performance in Norway, Anne-Lise Løfsgaard (pictured above), managing director of the Association of Norwegian Finance Houses (FINFO), stated: “In Q2 2015 the market for new leasing business in Norway dropped 1.6% compared to Q2 2014, whereas there was a smaller decrease in Q3 2015 of 0.4% compared to the same period a year earlier. When we look at the market for equipment leasing there was a year-on-year increase of 5.5% in Q2 2015 and 6.1% in Q3, while the passenger car and vehicle market decreased by 10.3% in Q2 2015 but by the lesser figure of 8.8% in Q3.”

She added: “As you see from the figures, there is a positive development from Q2 to Q3 2015 compared with the same periods in 2014.”

However, regarding the near-term prospects, Ms Løfsgaard said: “Businesses are expecting at the best a flat market for the next six months. There is still uncertainty regarding the development of the Norwegian economy. There will be low growth in companies’ investment in the coming year.”

Leasing in the Baltic States

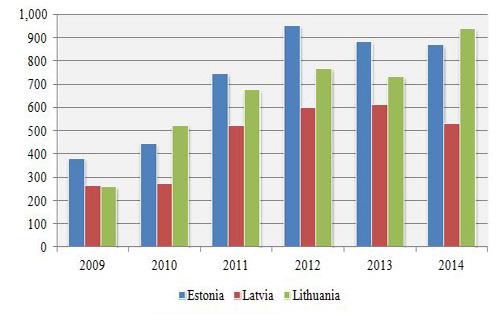

In the smaller, emerging asset finance markets in the Baltic States, overall growth rates since 2009 have been far greater than in the Nordic nations, although these have come from a much lower starting point.

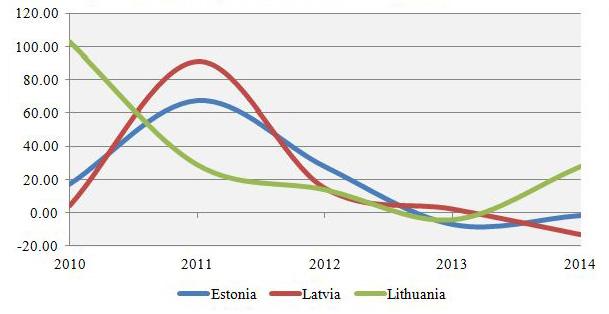

Even so, as the charts below show, it has not been a case of straight growth all the way. NBV in Estonia declined in 2013 and 2014, Latvia has been on a downward trend and also went into decline in 2014, and Lithuania also faltered in 2013 before returning to strong growth in 2014. Like Finland, these economies are bound to be influenced by Russia’s ongoing stagnation, and all are members of the eurozone and so subject to both the opportunities and the disadvantages that can bring, but these factors have so far not had too great an effect on their leasing sectors.

Baltic States, leasing new business volume (€ million)

Source: Leaseurope

The national growth trends over the five-year period, as shown by the CAGRs, has slowed slightly for Estonia and Latvia as their leasing markets have slowed but they remain impressive, and the market in Lithuania continues to power ahead, making it now the largest in the Baltics region.

Baltic States’ leasing markets combined annual growth rate, 2009−2014:

- Estonia: +18.00%

- Latvia: +15.17%

- Lithuania: +29.45%

Baltic States, new business volume change over previous year (%)

Source: Asset Finance International, Leaseurope

New business in the Baltics has continued well so far in 2015, at least in Latvia. According to the Latvian Leasing Association, NBV in the first half of the year increased 19.3% over the same period a year earlier to €328 million. Meanwhile, the Estonian Leasing Association reports “slight growth” of 4.5% in new business over a similar period.