Businesses in the UK remain cautious, despite improving levels of confidence about future growth, new figures suggest.

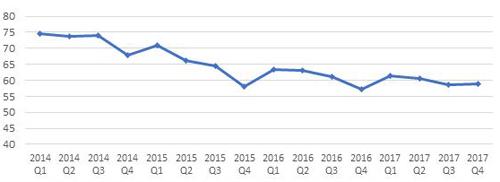

Analysis by Bibby Financial Services shows that its SME Confidence Index edged-up in Q4 2017, reaching 58.8 and halting recent declines.

Its research also shows that SMEs are planning to invest, but Edward Winterton, UK CEO of Bibby Financial Services, warned that the improving outlook could be fragile.

He said: “While confidence among small businesses remains low, there does seem to be light at the end of the tunnel, with SME owners now starting to think about investing for the future.

“However, while there are signs that confidence is edging back, it remains to be seen whether this is sustainable.”

Brexit will continue to be the Achilles heel of business confidence during 2018 as key issues relevant to future profitability depend on the current negotiations, such as the potential for upfront payment of VAT on goods imported from within the EU and the UK’s membership of the customs union.

Winterton said: “Such issues continue to plague SME plans for the future and stifle confidence in the wider economy.”

The Bank of England’s recently released Money and Credit report shows that improving confidence isn’t reflected in the business finance markets, where lending is declining.

Daniel Bailey, managing director of business lender Arkle Finance, said: “The Bank’s figures reveal the stark disconnect between the political mood music on Brexit and businesses’ appetite to borrow.

“December’s mini-breakthrough in Brexit negotiations prompted a rise in the Pound and an outbreak of optimism - even among Remainers - that Brexit might not be as bad as they’d feared.

“Yet on the business front line, that sentiment remains in short supply. Bank lending to businesses slumped by £1bn in December alone, and loans to SMEs shrank at the fastest rate for three years.”

He argued that the reason is a “profound sense of caution” which dominates businesses’ approach to growth. Even strong and successful companies are wary of taking on more debt to fuel further expansion.

However, this could benefit alternative forms of funding, such as asset finance.

Bailey said: “In the current climate we’re seeing increasing numbers of businesses playing a waiting game - conserving cash reserves and seeking non-bank forms of funding such as asset finance rather than taking on conventional debt.

“Many business borrowers are deeply cautious and seeking non-bank sources of finance, rather than tying up all their credit lines with the bank they use for day-to-day banking.”

His view was echoed by Paul Goodman, chairman of the National Association of Commercial Finance Brokers (NACFB).

He pointed to a “noxious combination of ongoing uncertainty and squeezed consumer confidence” affecting companies’ willingness to spend.

However, Goodman added: “It has to be remembered that [the Bank of England Report] is just a narrow snapshot of the whole market. Lending levels outside of the UK's main banks are continuing to hold steady, a sign that businesses are continuing to seek finance outside of the traditional avenues for growth.

"What we need now is a concerted effort from the government to signal to SMEs that all the UK's lenders are open for business.

"An ongoing awareness programme highlighting the full spectrum of finance options outside of just high street lenders will certainly help."

SME Confidence Index

Source: Bibby Financial Services