Odessa is the headline sponsor of Asset Finance Connect Summer 2024 Conference

Odessa is the headline sponsor of Asset Finance Connect Summer 2024 ConferenceMay 23, 2024

|

CASE STUDY: how to optimise lease renewals using machine learningPresentation for lending professionals on the practical application of machine learning as a predictor of a lease entering a renewal period followed by Q&A's.

|

Asset Finance Connect launch CTO Forum with FinativChief technology officers of auto and equipment finance seeking to stay up-to-date with the latest fintech solutions to incorporate into their technology stack now have a community where they can share their experiences about emerging technologies and learn about the latest solutions which are under development.

|

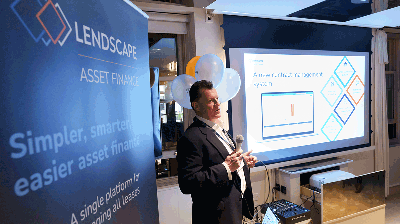

HPD Lendscape targets underserved mid-tier lenders as it seeks to demonstrate its asset finance offeringHPD Lendscape’s celebration of the launch of its lending solution, delayed by COVID-19, went ahead last week at the Groucho Club with asset finance lenders attending in force. The launch event not only publicly announces the company's interest in the asset finance market but reveals their intention to differentiate from the incumbents with a modern, progressive back-end solution.”

|

CGI deploy cyber escape room to raise profile of cyber securityAsset Finance Connect joined teams from across the auto and equipment finance team to try out CGI’s escape room designed to raise awareness of cybersecurity.

|

New report highlights challenge for auto finance in juggling short and long term market changesThe automotive market is undergoing a major transformation, as the shift from private ownership of vehicles towards shared on-demand services gathers pace. Previously, the focus was on providing a single vehicle to a single user, now the trend is for providing services tailored to the consumer’s needs at any particular point in time. That can mean one car with multiple owners, or making multiple cars available to a single user.

|

Why auto companies need to share their data: hear Chris Ballinger speak about blockchain at the IAFN Conference and AwardsGartner’s Hype Cycle places emerging technology on a hype line plotting the variation of users’ expectations over time. The technology then moves by stages, from users’ first realisation of its potential to solve problems, through to a period of over-inflated expectation. This is followed by a period of rapid disillusionment - and finally a gradual steady and much slower rise in expectations and recovery as industries learn the serious and effective uses of the technology.

|

Alfa: Insights from QCon London, 2017At Alfa we attend a range of technology conferences in order to learn and improve, meet other developers, and share ideas. QCon is a conference focused on innovation, and unlike many of its counterparts uses an editorial panel to appoint speakers by special invitation only. Alfa attends QCon London every year, and we always uncover new knowledge about the latest computer science research, new architectures and approaches, and benefit from lessons learned by other agile teams.

|

CHP Consulting rebrands as AlfaCHP Consulting, the makers of Alfa Systems, has announced it is to rebrand. The company will now be known as Alfa, with an exciting new website alfasystems.com launched to accompany the new name.

|

Toyota Financial Services selects White Clarke Group’s CALMS Digital Processing SolutionWhite Clarke Group has announced that it has been chosen as preferred supplier by Toyota Financial Services (UK) PLC to implement CALMS Digital Processing Solution including e-signature and e-identity.

|

The Seven Wonders of JavaOne 2016Every year, Java experts from around the world gather at JavaOne. CHP discusses what the latest conference can bring to our product and development process.

|

CASE STUDY: how to optimise lease renewals using machine learning

CASE STUDY: how to optimise lease renewals using machine learning Asset Finance Connect launch CTO Forum with Finativ

Asset Finance Connect launch CTO Forum with Finativ HPD Lendscape targets underserved mid-tier lenders as it seeks to demonstrate its asset finance offering

HPD Lendscape targets underserved mid-tier lenders as it seeks to demonstrate its asset finance offering CGI deploy cyber escape room to raise profile of cyber security

CGI deploy cyber escape room to raise profile of cyber security New report highlights challenge for auto finance in juggling short and long term market changes

New report highlights challenge for auto finance in juggling short and long term market changes Why auto companies need to share their data: hear Chris Ballinger speak about blockchain at the IAFN Conference and Awards

Why auto companies need to share their data: hear Chris Ballinger speak about blockchain at the IAFN Conference and Awards Alfa: Insights from QCon London, 2017

Alfa: Insights from QCon London, 2017 CHP Consulting rebrands as Alfa

CHP Consulting rebrands as Alfa Toyota Financial Services selects White Clarke Group’s CALMS Digital Processing Solution

Toyota Financial Services selects White Clarke Group’s CALMS Digital Processing Solution The Seven Wonders of JavaOne 2016

The Seven Wonders of JavaOne 2016