Newly released figures from the UK government have revealed a soaring tax burden for the nation’s company car drivers.

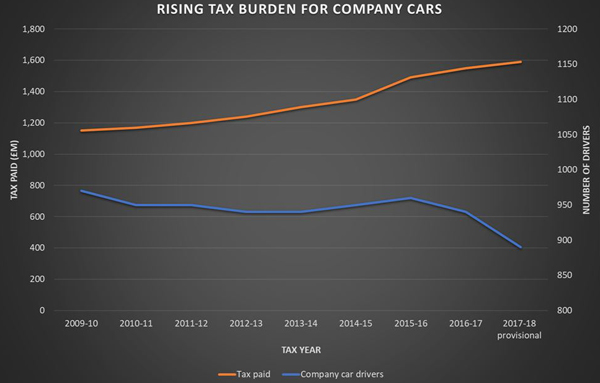

Total tax revenue has risen relentlessly for a decade despite a declining population of drivers; on average, company car tax is now 50% higher than it was in 2009.

Next year, the burden is expected to increase further for many, as vehicles currently on the road are hit by planned tax rises and newly registered cars are assessed under a controversial new system for calculating emissions-based taxes that is expected to increase bills.

The number of tax-paying company car drivers fell by 50,000 to 890,000 in 2017/18, according to provisional figures from HM Revenue and Customs, and there is an ongoing debate about the cause of the decline.

Critics say government policy is forcing drivers to opt-out of company cars or employers to scrap car schemes altogether in favour of cash alternatives. However, HM Revenue and Customs says its latest figures do not include any estimate of the impact of voluntary payrolling, which could account for a ‘significant proportion’ of the decline in reported numbers.

Voluntary payrolling was introduced in 2016 and allows employers to move away from submitting annual returns on their company car fleets through form P11D; instead they collect tax on company cars through payroll, which until recently didn’t require more detailed information about company cars; providing this data was not mandatory until 2018-19, so there is a gap in accurate information.

Although next year’s BIK statistics will include any company car recipients that could have been previously hidden, the latest analysis clearly shows the additional financial burden being placed on drivers and fleet operators.

Between the 2009-10 financial year and 2017-18, the total tax bill imposed on drivers rose from £1.15 billion to £1.59 billion, a rise of 38%.

Employers pay Class 1A National Insurance Contributions on the taxable value of company cars and this bill rose from £480 million to £660 million over the same period.

In total, the tax burden for operating company cars has risen £620 million in a decade, with above inflation increases imposed every year.

The average total tax burden for a company car, based on the total national tax bill divided equally between drivers, has leapt 50% from £1,680 a year to £2,528.

The punishing increases are being felt most by the ‘squeezed middle’, drivers in standard company cars who account for most tax revenue.

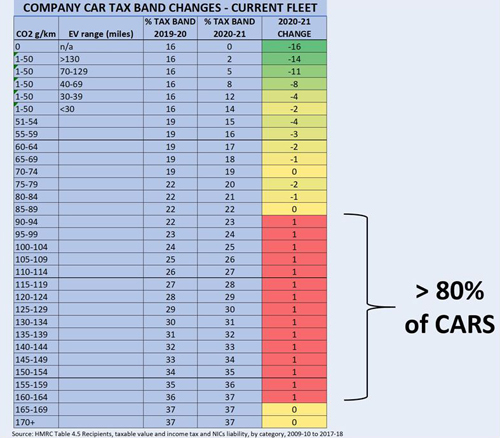

Drivers pay company car tax for personal use of business vehicles, with their bill calculated according to a percentage of the price of their cars. This percentage is derived from a car’s CO2 emissions, based on a tax band that increases as CO2 emissions rise.

The bands are altered annually, pushing up tax bills, to encourage drivers into newer, cleaner cars to minimise charges; the rising price of cars also helps to increase the amount of tax paid.

Next year is likely to bring more tax rises for many with the introduction of a new company car tax system that uses an updated way of calculating emissions called the Worldwide Harmonised Light Vehicle Test Procedure (WLTP), which is designed to more accurately reflect a car’s on-road emissions.

This is likely to push up official emissions for most cars, so to maintain a level playing field, the government has introduced tax band reductions for company cars registered from April 2020 to coincide with the new system coming into force.

ACFO, the UK fleet operators’ association, warns the new tax system is unlikely to compensate for higher CO2 emissions as a result of WLTP testing.

ACFO chair Caroline Sandall (pictured) said: “The Government has acknowledged that evidence provided to it by the industry showed that CO2 emission figures under WLTP testing were on average 20-25% higher than under the previous NEDC regime and in some cases up to 40% higher.

“It is ACFO’s belief that the reduction in rates for two years is unlikely to compensate drivers fully for the increase in emissions, although it will soften the blow.”

The new system does not apply to drivers in cars registered before April next year, but the majority will still incur tax rises if their cars emit more than 95g/km.

Latest HMRC figures suggest that more than 80% of drivers who stay in their current company car will see their tax bill rise next year, except for a small number in ultra-low emission vehicles, who will qualify for discounts.

Earlier this year, at the International Asset Finance Network Conference, in London, delegates heard that companies and businesses across Europe are having to rethink their fleet policies because of external factors including taxation.

A Fleet News poll last autumn suggested that three-quarters (74.8%) of respondents were seeing an increasing number of employees choosing cash rather than a company car because of the rising tax burden and uncertainty over future tax rates.

Paul Hollick, chairman of the Institute of Car Fleet Management, said: “The migration of employees out of company cars is well established as identified by HM Revenue and Customs’ data going back over many years.

“ICFM fears that the Government has not done enough in reviewing company car benefit-in-kind tax to either stop, slow down or reverse that trend.

“As a result, through its own company car benefit-in-kind tax strategy it is undermining one of its major policies - driving fleets towards a zero-emission future.”

Last year, delegates at the annual International Asset Finance Network conference heard that a growing army of employees are opting for the cash alternative, so they are free to source their own vehicles instead. According to the British Vehicle Rental and Leasing Association's Quarterly Leasing Survey for Q1 2019, the personal leasing fleet grew 25%, while the business contract hire fleet fell 11%

In response, the leasing industry is adapting to offer new services to retain their business as drivers change from fleet to retail customers. The shift is bringing a wide range of challenges as the market shifts from a B2B to a B2C environment, including the need for new skillsets among leasing company employees to manage a different type of customer journey.

Miguel Cabaça, managing director of Arval UK, told the IAFN conference in London: “It’s not exactly the same thing communicating to a driver who is part of a corporate customer car driving scheme versus a private customer that has chosen a car and is paying for it. You may say that 80% of the contact is the same but there’s 20% which is very different.

“If we manage to create some internal disruption and accommodate some change, I think as an industry, we’ll be able to cope with the future changes coming from the next five to 10 years.”

A briefing on the issues facing the leasing industry as it manages the trend towards personal leasing is available in this exclusive video, provided courtesy of global financial software supplier White Clarke Group.